Crypto Bros and the $31 Trillion Blind Spot

Unpacking why Web3's gender gap isn't just an equality issue – it's a huge blind spot. The most expensive paradox: an industry that pays women more but gives them less.

Walk into any major crypto conference and play a quick numbers game. Count the speakers, the founders, the VCs. Now count the women.

The math will make you uncomfortable.

In an industry obsessed with numerical precision – where success is measured in basis points and microseconds – we've created a gender imbalance so stark it would make traditional finance blush.

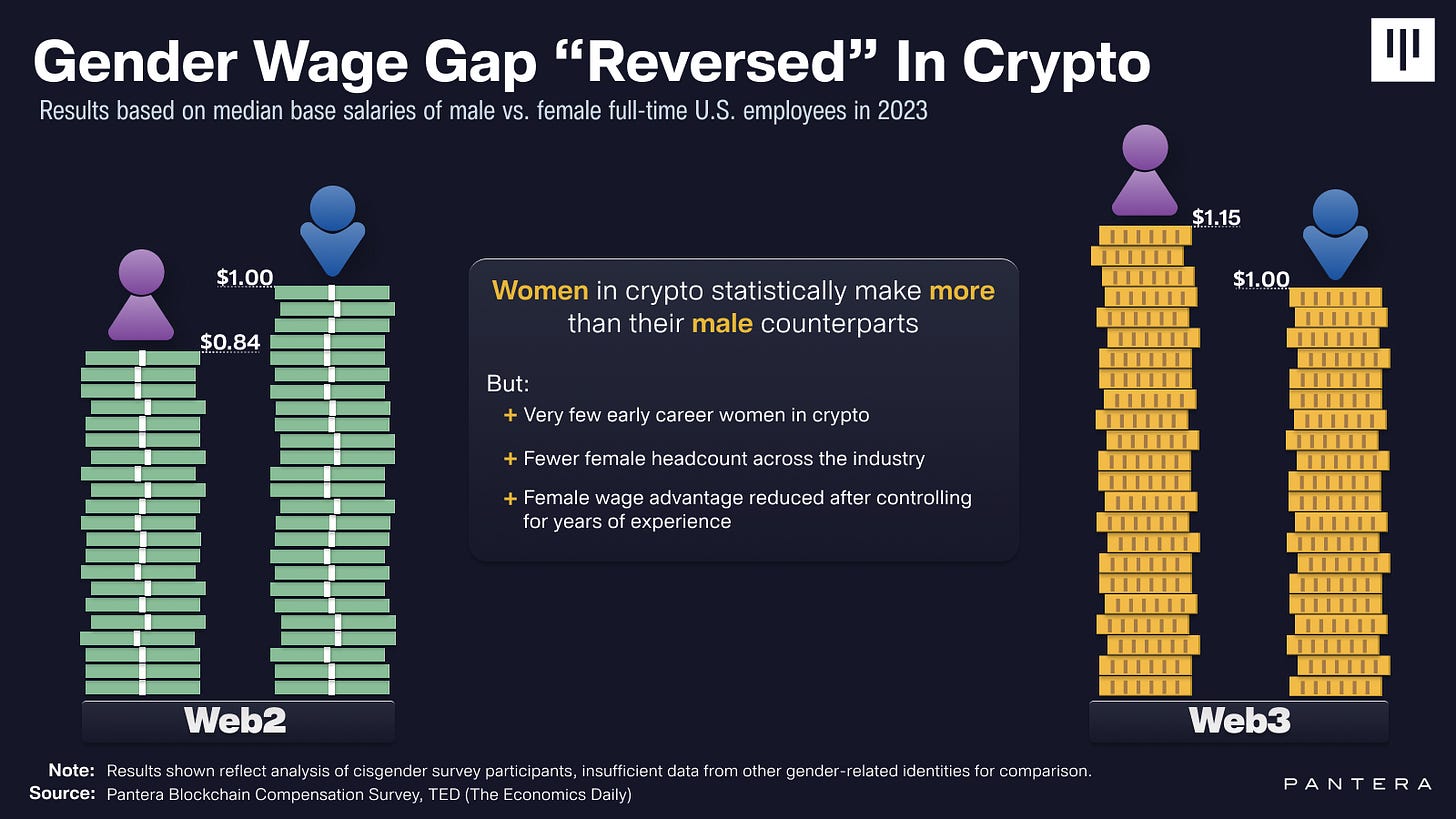

We're actually paying women more than men.

According to Pantera Capital's research, women in crypto earn a median salary of $172,000 – a full 15% more than their male counterparts.

In any other industry, this would be revolutionary.

In crypto, it's a smokescreen.

Peek behind those impressive salaries and you'll find a $32 trillion blind spot.

That's the global spending power controlled by women – a market force that's largely locked out of Web3's building phase.

While women direct 85% of consumer spending in the US, they're founders in just 13% of Web3 projects.

The math doesn't add up, and neither does the logic.

We're watching history repeat itself?

Just as Wall Street perfected the art of paying women handsomely while keeping them away from true power, Web3 is creating its own version of the glass ceiling – except this one's built on a blockchain.

The irony would be delicious if it weren't so damaging.

Consider the funding gap: all-male founding teams raise nearly $30 million on average, while all-female teams scrape by with $8 million. Among Web3 companies that have raised over $100 million, the number with all-female founding teams is a perfect zero.

It's not that women can't succeed in crypto – they demonstrably can.

Yi He rose from a remote Chinese village to co-found Binance, now the world's largest crypto exchange.

Gracy Chen jumped from TV hosting to running Bitget's $4 billion trading empire. But these are the exceptions that prove the rule.

What’s truley puzzling? This disparity exists in an industry literally built on the premise of democratising finance.

Women in crypto actually have more experience than men (5.3 years versus 4.5) and dominate mid to senior-level positions. Yet somehow, when it comes to founding companies or raising capital, they might as well be invisible.

Some VC firms are finally catching on, requiring at least one woman on investment teams after realising that all-male teams tend to back all-male founders.

It's a start, but it feels a bit like installing a single ramp in a building full of stairs and calling it accessible.

Women are already proving they can succeed in crypto, often outperforming despite the odds.

My question is whether crypto can succeed without them.

Because right now, we're running a fascinating experiment: what happens when you build a new financial system while ignoring half your potential users?

The early results suggest we're creating exactly what we set out to replace – just with fancier technology.

The "crypto bros" stereotype isn't just tired – it's expensive.

While the industry has been busy cultivating an image of hoodies and lambos, it's missing something far more valuable?

Market insight.

Women's investment strategies typically outperform men's by 0.4% to 1%.

Fidelity’s 2023 report agrees.

They're more likely to focus on long-term value than short-term gains, and they're better at spotting sustainable trends versus hype cycles.

In an industry plagued by pump-and-dumps and speculation, that kind of perspective is useful and sometimes crucial.

The real opportunity goes beyond investment returns.

Women can be better investors? Sure. But also they're different users with different needs.

They approach risk differently, value community more highly, and are more likely to prioritise practical utility over speculation.

These aren't feminine qualities – they're product insights.

By keeping women away from founding and funding roles, we're missing out on talent while also missing out on an entire perspective on how crypto could actually be useful to the other half of the population.

And in a $32 trillion market, that's just bad business (and bad ethics ofcourse).

Maybe it's time we admitted that "crypto bros" isn't just an outdated stereotype – it's a competitive disadvantage.

Buttercup Picks: The Good Reads

Meet the women behind the world’s largest crypto exchanges - by Zhiyuan Sun, Cointelegraph, May 23, 2024

Being a girl in crypto - by Girl In Crypto, December, 2024

I Didn't Care About Crypto Until It Gave Me Back My Life - by Girl In The Verse, January 7, 2025