We all gamble. Gamblers like to predict

From horse races to card games, humans always loved risk for potential reward. Prediction markets are collective wisdom of crowd. Crypto adds decentralisation spice. But is it really just gambling?

I grew up in India. I’m supposed to be steeped in the rich tapestry of our ancient mythology.

Purana, Vedas, Jungle Book. Oh, wait … that’s not one of them?

I wouldn’t know the difference.

My family? Let's just say they're more into Karl Marx than Krishna.

There’s a good chance Marx would have actually liked cryptocurrencies. Dude was all about decentralisation. He had a good potential to be a memecoin inspiration. For reals. But that’s for another day.

Back to Indian mythology.

There’s one story that has always fascinated and terrified me. From Mahabharata. The epic. Generations in Indian have grown up watching it on telly, a Sunday feast for collective watching for families across the country. I missed it as a child. But I caught up as a teenager. I like Krishna. Who doesn’t?

A classic tale of greed, hubris, and the devastating consequences of gambling.

Let’s go to Chapter 9 - The Gambling Match.

Yudhishthira was the prince of Hastinapura, an ancient kingdom located in northern India.

Good at throwing dice. Like, so good, he could probably beat a seasoned craps dealer.

But, being a prince, he decided to use his skills for something a little more ... royal. He challenges his evil cousins to a game of dice, thinking, "How bad could it get?"

Well, let's just say it didn't end well.

He lost everything. Kingdom? Gone. Wealth? Poof. His wife? She's now a pawn in his cousin's twisted game.

They didn’t treat her right. Our girl was traumatised.

That dude who is making sure that the drape don’t end. He is Krishna. He is worshipped globally. Like really. Did I tell you I like Krishna?

This game of dice unraveled the Mahabharata.

It triggered the epic battle. Between cousins. The good and the evil.

All because Yudhishthira thought he was a hotshot with a pair of dice.

This one has everything: excitement, fear, drama, good looking princes, patriarchy and enough family drama to make the Kardashians look like a choir of angels.

I am writing to build the foundation for my argument on crypto prediction markets.

It’s a strange juxtaposition, isn’t it?

But there’s a common thread: the thrill of risk, the hope of striking gold, and the potential to lose your shirt (in Paanchali’s case, literally).

We all are gamblers. Each one of us.

We love a challenge, a puzzle to solve, a bet to make. A stake that we want to double. Every decision we make involves an element of risk and uncertainty.

Whether it's choosing a career path, investing in a new business, what to wear, or simply deciding how to torture your own cousins and their wife (singular), we are constantly weighing the potential outcomes and making predictions based on limited information.

In the little decisions. In big decisions. In all decisions. All our lives, we gamble.

In our own little ways we are gambling our lives away.

Think of it. Everything is a gamble. Everything. It happens everywhere.

And gamblers like to predict.

We crave certainty in an uncertain world. This desire is at the heart of gambling.

The history of prediction is as old as civilisation itself.

Ancient cultures relied on oracles, seers, and other mystical figures to divine the future.

As society progressed, these methods gave way to more scientific approaches, like mathematical models and statistical analysis.

But even as we became more rational, the allure of predicting the unknown remained. And that led to gambling.

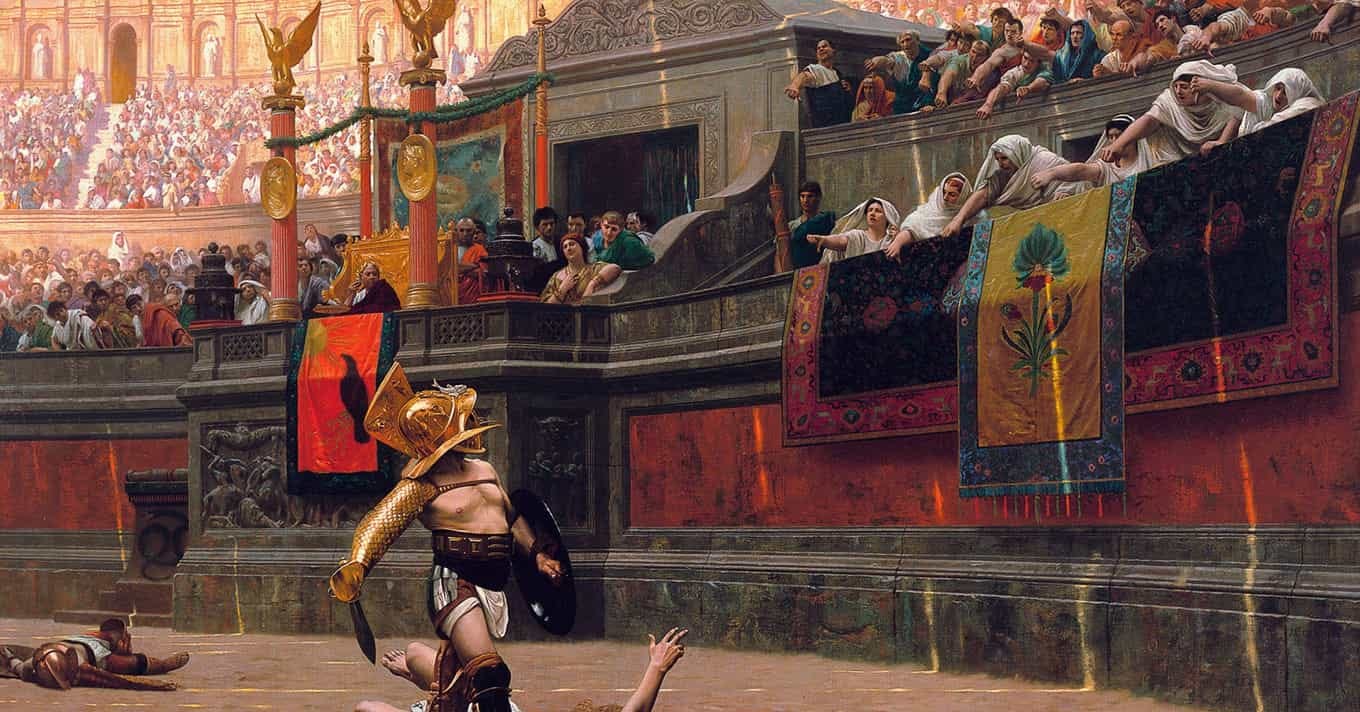

The Colosseum? Where ancient Romans bet their fortunes on gladiators fighting to the death.

Proof that even ancient Romans knew that nothing is more exciting than a good gamble.

Drumroll prediction markets

These are modern boards for the game of dice? Not quite.

Unlike conventional gambling, prediction markets serve a higher purpose: aggregating diverse information to produce precise forecasts.

Explainer: Prediction Markets

These markets are where finance meets fortune-telling. They're not just games of chance – they're turbocharged truth-seeking machine.

The crystal ball economy.

Imagine politicians making decisions based on actual data instead of the last lobbyist's whisper.

Picture companies tapping into their workforce's collective wisdom, turning employees into forecasting supercomputers.

That's the promise of prediction markets, and it's got economists and policy makers all excited.

Let’s talk about elections. I vote for the candidate who aligns perfectly with my values (which doesn’t involve much of cow dung). Then there is the candidate they believe is most likely to win.

I obviously vote for the former one in the ballet. But am I betting my money on her/him in prediction markets? NO! I want to buy a microwave. So, I bet on the cow dung.

Bonus: Whoever wins, I have something to be happy about.

People vote with their wallets. People morally support their sentiments.

Folks tend to support candidates and policies that boost their bank accounts. But I’d say don’t vote with your wallets. Your single vote is like a drop in the ocean— So, betting your vote solely on financial gain doesn’t really add up.

Critics argue they're just glorified gambling dens, but they're missing the point. Prediction markets are like Wikipedia for the future.

In a world where uncertainty is the only certainty, prediction markets are offer a glimpse of clarity in the chaos.

It's cooler, it's smarter, and who knows? You might just help save the world while padding your wallet.

They're social epistemic tools that could revolutionise decision-making across industries. Vitalik called it out.

Crypto tried everything to go mainstream.

ICOs to memecoins to digital arts. Play2Earn games are still a vogue that’s riding Telegram’s TON chain high. Even drawing the pull of Universal Basic Income. Rewarding the folks for the time they give.

The new money that’s borderless and uniform.

Wild west of finance.

But what actually worked?

Crypto’s decentralised prediction markets.

I bet you have heard of Polymarket. Also about Azuro, Drift, Betfolio and Augur.

Shayne Coplan, a 26-year-old native of New York City, realised that in 2020 and founded Polymarket.

But Polymarket for sure. You don’t have to be a big crypto fan to know this label.

Nate Silver, founder of FiveThirtyEight, became an advisor in July 2024 to enhance analytical capabilities.

You follow the US election 2024, then you know what I am talking about.

Remember when everyone was talking about whether Donald Trump would pick JD Vance as his VP or if Biden would drop out of the race?

Well, Polymarket was the place to be for those predictions, and guess what? It turned out to be spot on.

Right now, Kamala Harris is winning all polls, thanks to that kick arse Trump vs Kamala debate. She just didn’t trump Donald, she scrubbed clean his ego.

Read: Do Crypto Prediction Markets Matter? 🤔

Let’s talk numbers?

Raised $70 million in May 2024, with contributions from notable investors including Peter Thiel and Vitalik Buterin.

The monthly volume hit $470 million in August.

The biggest bet: $1 billion in bets for 2024 presidential election winner. All of them gamblers.

Polymarket is so popular that it is now integrated with Bloomberg Terminal to provide election odds data. Plus, the new adviser of the firm? Nate Silver.

Polymarket can indicate what the world believes about the future. Not what the world wants from the future.

Let’s get back to Mahabharata.

We have Shakuni, the uncle of the Kauravas. Big cheater.

He manipulates the dice by loading them in his favour. This means that the dice are weighted or altered in a way that makes it more likely for him to roll the desired combination.

This gave him a significant advantage over the Pandavas. And he is such a Karen.

Market manipulation, regulatory headaches, and the eternal struggle for liquidity are the hurdles for prediction markets. Apart from the big, collective social label of gambling.

Can prediction markets be manipulated? Billion dollar question.

Prediction markets don't have Shakuni. But they do have well-capitalised market participants.

There’s a dominance by these sophisticated traders and not everyday gamblers.

For example, Polymarket in August - $473 million of bets placed by 64,000 traders. An average bet of over $7,000 per trader during its busiest month.

This shows a market skewed towards experienced bettors? Maybe.

Yes, some players have way more chips than others.

But as the game gets bigger, the big players' influence gets smaller?

Why? Because the more people play, the more clues we get. Crowd wisdom thing really works.

Economists Robert Webb and Robin Hanson agree.

They say that the fear of manipulation is overblown and that prediction markets are actually pretty accurate.

“The economic literature suggests that prediction markets are fairly accurate.” - Webb

“It’s a generic feature of having any information source people might rely on that people might want to try to distort it.” - Hanson.

The US regulators don’t think so much. Do they?

How can something decentralised, popular and so cool be allowed to exist - that’s the thought. No in depth analysis and no anecdotes on Mahabharata.

So, we are looking at the Commodity Futures Trading Commission (CFTC) v. Kalashi war right now.

What is Kalashi?

Kalshi is challenging the CFTC's decision to block its political event contracts

Read: Prediction Markets Go to Washington's Appeals Court

Currently Polymarket doesn’t trade in the US. Thanks to the same CFTC and a $1.4 million fine in 2022.

If Kalshi gets the green light, it could open the floodgates for other prediction market players to join the US scene.

Otherwise, would prediction markets really take off in the US after this election hype?

Challenging the status quo always attracts people.

That’s why crypto prediction markets work.

Decentralised, transparent, accessible and borderless. Even better.

I don’t live in the US, I won’t vote in the US election, I still bet on who’s winning.

And I think Trump can make as many promises, release as many NFTs he wants and unchain the modern finance with his latest stunt with all his sons - World Liberty Financial.

Read: Trump's WLF: Triumph or Fiasco? ⚠️

We all know Biden won hearts when he said and we all UNDERSTOOD EVERY WORLD OF IT.

For Kamala or against Donald. Crypto trumps.

Crypto made this possible, and this whole thing a bit more fun.

Buttercup Picks: The Good Reads

Prediction markets work — even when they don’t - by Byron Gilliam, Blockworks September 3, 2024

Why prediction markets aren’t popular - by Nick Whitaker & J. Zachary Mazlish, Works in Progress May 17, 2024

Prediction markets are the killer blockchain app we've been waiting for - by Brian Trunzo, Cointelegraph September 10, 2024

How Polymarket and Nate Silver Want to Reshape Political Forecasting - by Nitish Pahwa, Slate August 16, 2024

Earn Crypto With Political Predictions - Polymarket Explained - YouTube - Whiteboard Crypto